The Crucial Role of Mortgage Pre-Approval in Home buying

Embarking on the journey of homeownership is an exciting and significant step in one’s life. Amidst the myriad of decisions and steps involved, mortgage pre-approval emerges as a pivotal process that lays the groundwork for a smooth and informed homebuying experience.

Understanding Mortgage Pre-Approval:

Mortgage pre-approval is more than just a routine step; it’s a strategic move that involves submitting a comprehensive application and financial documentation to a lender. The lender then diligently reviews this information to determine if the applicant qualifies for a specific loan program. This crucial step provides potential homebuyers with a clear indication of their purchasing power in the real estate market.

Guiding Your Home Search:

Armed with a pre-approval letter, homebuyers gain a distinct advantage in the competitive real estate landscape. This document not only assures sellers that a prospective buyer is serious and financially capable, but it also helps the homebuyer understand their budget constraints, guiding them towards properties within their means.

The Significance of the Pre-Approval Letter: A pre-approval letter serves as a testament to the borrower’s financial credibility. It assures sellers and real estate agents that the buyer has undergone a thorough financial review and is deemed creditworthy by a lending institution. This can be a game-changer in a competitive market, potentially giving the buyer an edge in negotiations.

Understanding the Expiration Date: While securing a pre-approval is a critical milestone, it’s equally important to be mindful of its expiration date. Typically ranging from 60 to 90 days, this timeframe represents the window during which the buyer should finalize a home purchase. Beyond this period, the lender’s assessment may no longer accurately reflect the buyer’s current financial situation.

The Impact of Expiration on the Homebuying Process: Allowing a pre-approval to expire without renewal can have adverse effects on the homebuying process. A lapsed pre-approval may lead to delays, as the buyer must restart the application process, providing updated financial information. Additionally, changes in the buyer’s financial circumstances or market conditions may affect the loan terms.

The Renewal Process: Renewing a pre-approval is a relatively straightforward process. It typically involves revisiting the lender, providing any necessary updates to financial documentation, and having the lender reassess the buyer’s qualifications. Timely renewal ensures that the buyer maintains a strong negotiating position and avoids potential setbacks in the home purchase.

Conclusion: In the intricate dance of homebuying, mortgage pre-approval emerges as a choreographed move that sets the rhythm for a successful transaction. Beyond being a mere formality, it is a powerful tool that empowers buyers and streamlines the process for all parties involved. However, it’s crucial to treat the pre-approval letter with the respect it deserves, acknowledging its expiration date and proactively renewing it when necessary. By doing so, homebuyers not only affirm their financial standing but also ensure a seamless and confident march towards homeownership.

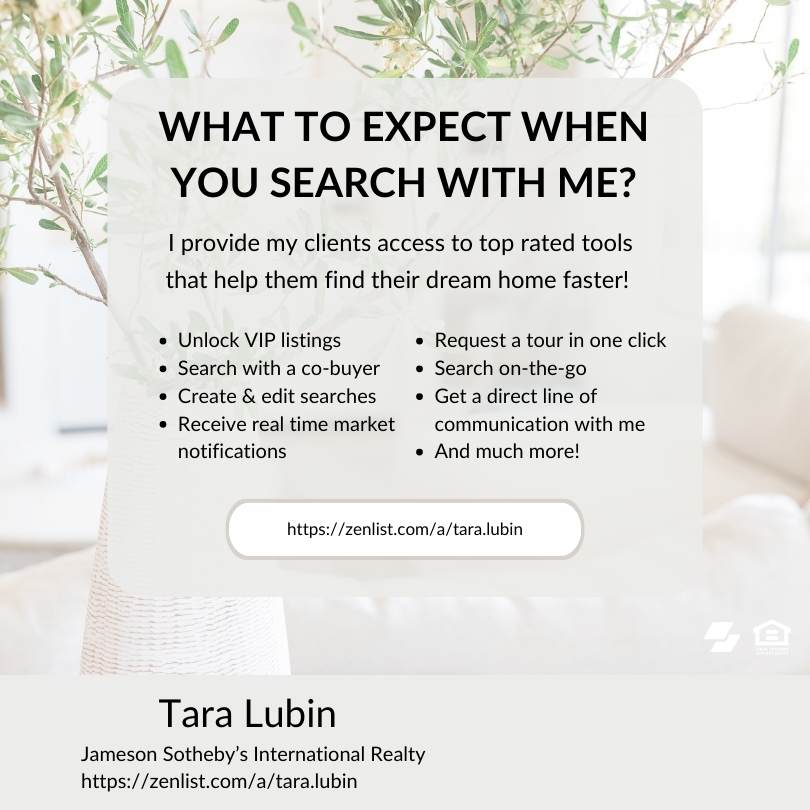

Call or contact me to if you have any Real Estate questions ~ I look forward to helping you. Tara Lubin | Jameson Sotheby’s International Realty REALTOR – Global Real Estate Advisor – Chicago & North Shore Suburban Chicago, Evanston, Wilmette, Winnetka, IL and beyond 630.707.3473 | [email protected] | [email protected]

0 Comments