Navigating Mortgage Payments: A Guide to Grace Periods, Late Fees, and Avoiding Foreclosure

Embarking on the journey of homeownership is an exciting and rewarding venture, but it comes with a set of responsibilities. One crucial aspect that homeowners need to navigate is the timely payment of their mortgage. Understanding the intricacies of due dates, grace periods, late fees, and foreclosure prevention options is essential for a smooth homeownership experience.

The Routine of Mortgage Payments:

In the world of homeownership, the rhythm is often set by monthly mortgage payments. Typically, these payments are due on the first day of each month. This consistent schedule allows homeowners to plan and budget effectively. However, it’s important to note that life can sometimes throw unexpected challenges our way.

Grace Periods: A Breathing Room for Homeowners:

Recognizing the unpredictable nature of life, most mortgage agreements include a grace period. This period, typically lasting for 15 days after the due date, serves as a buffer. During this time, homeowners can make their mortgage payment without incurring any penalties. It’s a valuable feature that provides a bit of flexibility for those facing temporary financial constraints.

Late Fees: The Consequence of Missed Deadlines:

If a mortgage payment is not made within the grace period, late fees come into play. Late fees are charges imposed by the lender for failing to meet the agreed-upon payment deadline. These fees can accumulate with each passing month that the payment remains outstanding. Therefore, it’s crucial for homeowners to be aware of the terms outlined in their mortgage agreement to understand the late fee structure.

Navigating Challenges: Options Beyond Late Fees:

Life’s challenges can sometimes lead to financial difficulties, making it challenging to meet mortgage obligations. In such situations, it’s important for homeowners to be proactive and explore available options to avoid the risk of foreclosure.

1. Loan Modification: A loan modification involves adjusting the terms of the existing mortgage to make it more manageable for the homeowner. This can include changes to the interest rate, the loan term, or even the principal amount owed. It’s a collaborative effort between the homeowner and the lender to find a sustainable solution.

2. Forbearance: Forbearance is another option for those facing temporary financial setbacks, such as job loss or unexpected medical expenses. It allows homeowners to temporarily reduce or suspend their mortgage payments. Once the forbearance period ends, a plan is devised to repay the missed payments gradually.

The Importance of Open Communication:

Whether exploring loan modification, forbearance, or any other option, open communication with the lender is key. Lenders are often willing to work with homeowners facing financial challenges, but it requires proactive engagement. Initiating a conversation early on can lead to more flexible and favorable outcomes.

Preventing Foreclosure: A Collaborative Effort:

Foreclosure is a distressing scenario that both homeowners and lenders aim to avoid. It’s a legal process through which a lender repossesses a property due to non-payment. By taking proactive measures such as exploring modification or forbearance options, homeowners can significantly reduce the risk of foreclosure.

Conclusion: Empowering Homeowners with Knowledge:

Understanding the dynamics of mortgage payments, grace periods, late fees, and available options in times of financial strain is empowering for homeowners. By staying informed and engaging in open communication with lenders, individuals can navigate challenges successfully and protect their homeownership dreams. Whether it’s making timely payments or exploring assistance options, the journey to homeownership is a collaborative effort that involves resilience, communication, and proactive decision-making.

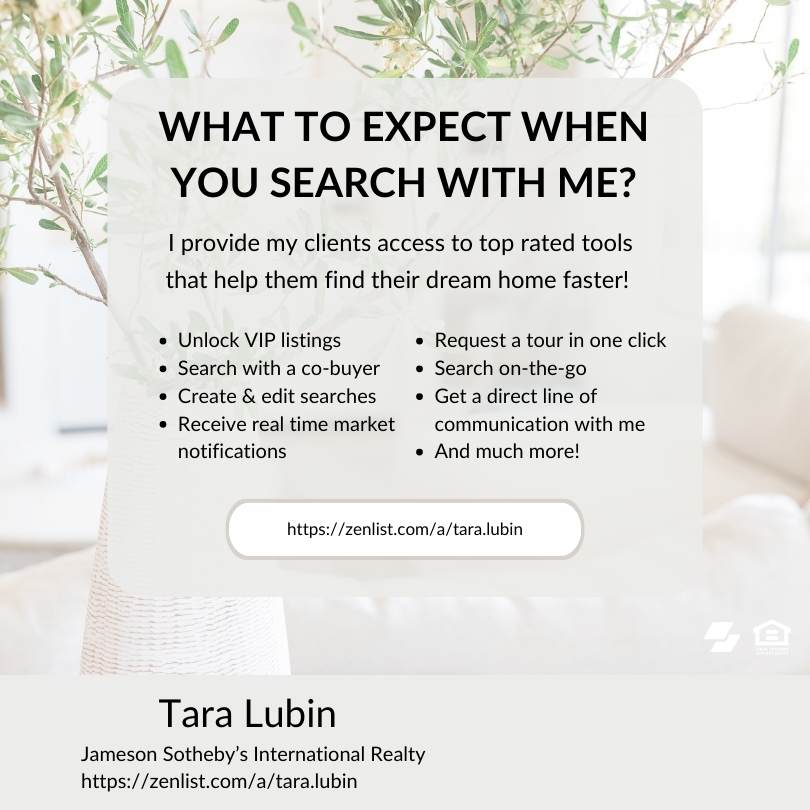

Call or contact me to if you have any Real Estate questions ~ I look forward to helping you. Tara Lubin | Jameson Sotheby’s International Realty REALTOR – Global Real Estate Advisor – Chicago & North Shore Suburban Chicago, Evanston, Wilmette, Winnetka, IL and beyond 630.707.3473 | [email protected] | [email protected]

0 Comments