Breaking Down Barriers: The Evolution of Down Payments in Home buying

Gone are the days when a hefty 20% down payment was the standard prerequisite for securing a home loan. In the evolving landscape of real estate, prospective buyers now enjoy a spectrum of options, with down payment requirements ranging from 5% to 20%, providing greater flexibility to tailor investments based on individual circumstances. Several factors, including credit score, income, and age, play pivotal roles in determining the down payment amount, and with the advent of favorable first-time homebuyer programs, the path to homeownership has become more accessible than ever.

1. Varied Down Payment Options:

The once-rigid 20% down payment norm has given way to a more accommodating range. Buyers can now explore down payment options that align with their financial capabilities, ranging from a modest 5% to a more traditional 20%. This shift has democratized homeownership, breaking down financial barriers and expanding opportunities for a diverse range of homebuyers.

2. Individualized Criteria:

Credit score, income, and age are instrumental in tailoring down payment requirements to individual circumstances. Lenders consider these factors to assess a buyer’s financial capacity and risk profile. While a higher credit score and income might unlock lower down payment thresholds, buyers with different financial standings can still find viable options that suit their unique situations.

3. Conventional Loans with a Minimum of 3%:

Conventional loans, once synonymous with the 20% down payment benchmark, have adapted to the changing landscape. Buyers can now secure a conventional loan with a minimum down payment of just 3%. This adjustment reflects a more inclusive approach, recognizing that a significant down payment is not always a realistic expectation for everyone.

4. First-Time Homebuyer Programs:

For those stepping into homeownership for the first time, there are specially crafted programs that ease the financial burden of down payments. These programs often come with even lower down payment requirements, creating a pathway for individuals or families who may be navigating the real estate landscape for the first time. Such initiatives foster inclusivity and encourage a broader spectrum of society to embrace the benefits of homeownership.

5. Accessibility and Affordability:

The evolution of down payment requirements aligns with broader goals of making homeownership more accessible and affordable. By recognizing that financial capacities vary among buyers, the real estate industry has become more attuned to the diverse needs of the market. This adaptability is a positive step towards dismantling barriers that historically limited homeownership to a select few.

6. Empowering a Diverse Range of Homebuyers:

The shift in down payment norms is empowering a more diverse range of homebuyers. Whether someone is just starting their career, navigating student loans, or facing other financial commitments, the evolving standards accommodate various life stages and financial situations. This inclusivity contributes to the creation of a real estate landscape that reflects the richness and diversity of its occupants.

Conclusion:

The evolution of down payment requirements in the realm of homebuying signifies a positive shift towards inclusivity and adaptability. From the broadened range of down payment options to tailored criteria based on individual circumstances, the real estate industry is evolving to meet the diverse needs of today’s buyers. As first-time homebuyer programs continue to foster accessibility, the dream of homeownership is becoming a reality for a more extensive and varied demographic. The key takeaway is clear: the doors to homeownership are opening wider, welcoming a new era of inclusivity and opportunity.

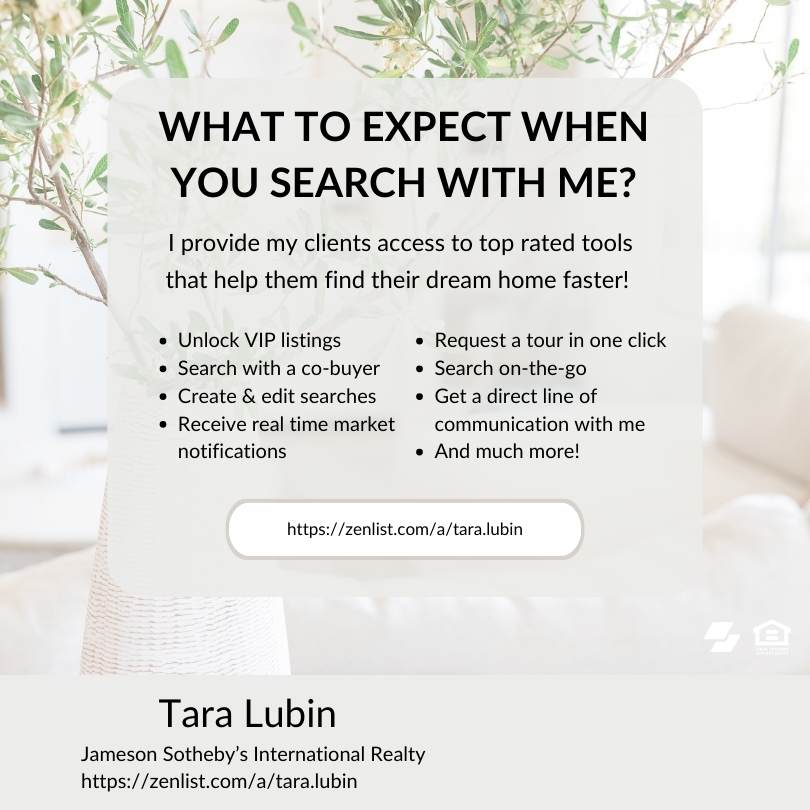

Call or contact me to if you have any Real Estate questions ~ I look forward to helping you. Tara Lubin | Jameson Sotheby’s International Realty REALTOR – Global Real Estate Advisor – Chicago & North Shore Suburban Chicago, Evanston, Wilmette, Winnetka, IL and beyond 630.707.3473 | [email protected] | [email protected]

0 Comments